Financial Report

Longwood University Foundation

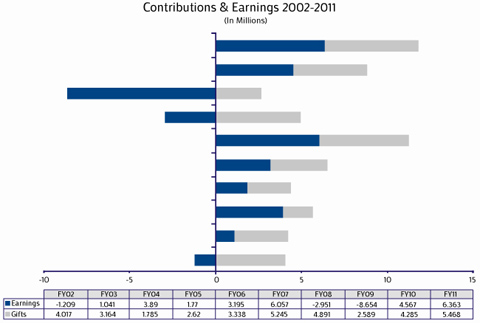

The fiscal year that ended June 30, 2011, showed much improvement over the last two years. According to the 2011 NACUBO-Commonfund Study of Endowments, returns were positive, reflecting the favorable investment environment that prevailed prior to the market downturn in the second half of the 2011 calendar year.

On July 1, 2010, the Foundation’s entire Russell Investment Group portfolio was moved to the Richmond Fund of the Spider Management Company. The Spider Management Company’s philosophy is aligned with that of the Foundation: preservation of the corpus, absolute rather than relative performance, a fully diversified portfolio and a long-term horizon.

Several financial achievements merit special attention:

- Return from first-year invested in The Richmond Fund was 17.87 percent.

- Contributions increased $1,182,493 over the previous year.

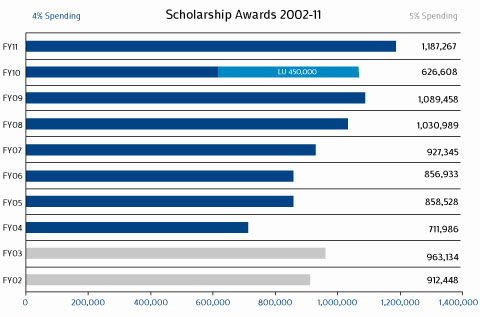

- Scholarship payments increased $120,659 over the previous year.

- Over 630 scholarship awards were distributed.

- Support to Longwood University increased $44,781.

A goal of the Foundation is to achieve investment performance that supports stable endowment spending from year to year in order to provide steady predictable funding for programs. For the fiscal year ending June 30, 2003, the Foundation Board of Directors approved a reduction of our spending rate by 1 percent. The overriding principle for this move is simple: Funds should be managed so that a gift today will fund a donor’s objective in perpetuity. The change to a 4 percent spending rate enables each individual endowment to maintain the real value of the endowment and keep pace with inflation.

In addition, the recent market crisis caused many of our endowed funds to be considered “underwater.” This means that the market values of these funds are now less than the original gift values. It was the Board’s position that these funds should be allowed to grow and strengthen once more. Therefore, fiscal year 2010 scholarship distributions were reduced to pay out at 90 percent of the normal computed amount. All scholarship funds that were underwater were paid using alternative funding sources from the University and Foundation so that the funds would not be further depleted and so that students relying on the awards would not be hindered from attending. Prudent decisions such as this have enabled the Foundation to sustain the distributions to the University for scholarships as well as other programs during such market downturns.

The Foundation wishes to specifically thank all those donors who were kind and willing enough to provide additional contributions to cover awards for some of these funds. Their generosity has been a great help during this crisis.

Cherry, Bekaert and Holland, PC, conducted its annual independent audit, and Longwood University Foundation received another unqualified audit. A copy of the annual audited financial statements can be found on the Foundation website. A more detailed report highlighting endowment activity and the Foundation’s management policies follows this summary.

Annual Report on the Pooled Investment Fund

This report has been prepared to provide information about our donor-raised funds and the management and performance of the Longwood University Foundation’s Pooled Investment Funds.

The Longwood University Foundation’s Board of Directors had delegated the investment management of the Pooled Investment Funds to the finance committee, which operates within the parameters of the Investment Policy.

The Finance Committee seeks investment returns through a diversified investment portfolio consistent with the approved Investment Policy. To achieve its investment objective, the Longwood University Foundation has retained an independent investment firm since April 2001 to provide ongoing evaluation of economic conditions, review manager performance and provide advice on asset allocation and performance enhancement.

The Longwood University Board of Directors has adopted the strategy of investing endowment assets to preserve the long-range purchasing power of the endowment and ultimately to provide intergenerational financial support for programs that the endowed funds were created to benefit.

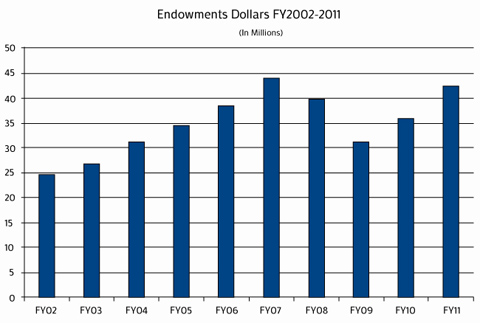

The endowed funds held by the Foundation provide a consistent level of support for current and future needs of Longwood University. The primary investment objective for the endowed funds is maintaining the purchasing power of each individual endowment over time by reinvesting part of the endowment’s earnings and appreciation each year. If the principal value of the endowment grows at or above the rate of inflation, an increasing stream of income will be generated to meet the rising costs of education, research and campus life. The chart below represents the fair market value of the endowment funds for each fiscal year over a 10-year period.

Investment Performance

The endowment’s performance is calculated on a total return basis, which measures the performance of equity, fixed income and alternative investments. Total return (for purposes of this report) is the combination of income, dividends, and gains and losses for the fiscal year net of investment management fees. Investment performance is determined on the endowment as a whole rather than on each separate endowed fund. Depending upon the timing of additions to an individual fund, returns on a specific endowed fund may vary from the following results.

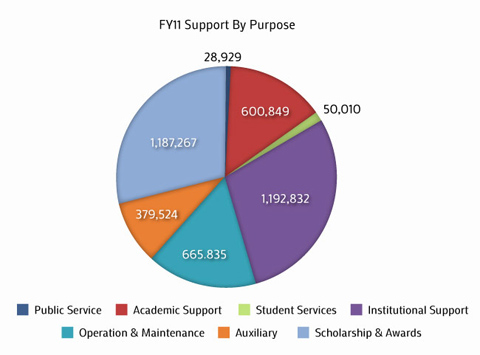

Foundation Program Support

Endowment funds and nonendowed funds support University programs as designated by the donors. Programs supported from endowment distributions include scholarships, fellowships, professorships, faculty development and department operating funds. Nonendowed funds support capital projects and college departmental programming.

Many important University activities could not be achieved without the financial support from the Longwood Fund. This year these funds made the following activities possible:

- Twenty-nine students received scholarships to aid with study abroad opportunities in China, Valencia, England, France, Spain, Greece, Tanzania, Egypt and Thailand.

- Twenty-six honor students were provided with academic scholarships.

- The Music Department’s Spring Choral Concert received critical support

- Refreshments were provided for 25 students who worked the Virtual International Recruiting Fair.

- Various offices and departments received operating funds.

These are only a few of the activities the Foundation’s unrestricted funds have supported during this past year. We are fortunate to have donor-raised funds that support University programs system-wide.

Longwood University Foundation’s endowments provide a permanent partnership between the University and the donor. The legacy of thoughtful donors plays a role in the life of the University in perpetuity, becoming the “foundation” upon which Longwood University can build its achievements. The generosity of Longwood University’s many donors is appreciated by generations past, present and future.

Submitted by

Hazel P. Duncan, MBA, CMA

Chief Financial Officer, Secretary and Treasurer

Longwood University Foundation

Click to Enlarge

Click to Enlarge Click to Enlarge

Click to Enlarge Click to Enlarge

Click to Enlarge Click to Enlarge

Click to Enlarge